What is a director’s loan account?

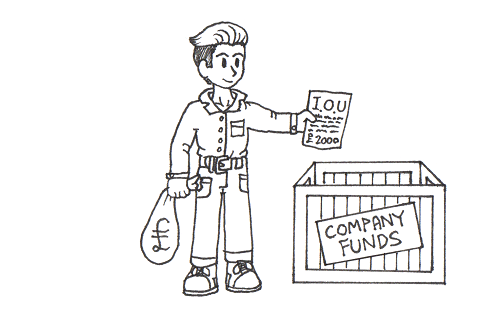

A director’s loan relates to all withdrawals by directors of a company from their business which isn’t salary, dividend or expense repayment or money that a director has previously paid into or loaned the company.

A director may receive a loan advance from his own company provided that it is not in financial difficulty and subject to adhering to the provisions of the company’s articles of association and the 2006 Companies Act. Shareholder and/or board approval

may also be required.

Records of any money borrowed from or paid into the company by the directors is recorded in the director’s loan account. In certain circumstances tax will need to be paid by the directors and the company on the director’s loans.

What does an ‘overdrawn’ director’s loan account mean?

If director’s loan account is overdrawn, this means the director owes the company money.

If the director owes the company money at the company’s financial year-end and doesn’t repay the loan within nine months after the financial year-end of the company, then the company is subject to a corporation tax charge. If a director owes the company money at the year end and pays it within 9 months after the financial year-end, then the company can claim for a repayment of corporation tax.

If a director owes the company £10,000 or more at any time during a year then it can be treated as a benefit in kind if your company doesn’t charge you interest at the official rate.

Each company is subject to Class 1 A NIC at 13.8% on the cash equivalent of the loan (value of the loan). An individual will have to pay income tax at 20% if basic tax payer and 40% if higher tax payer on the cash equivalent of the loan.

If a company charges a director with a loan interest which is lower than the official rate of interest, the interest can be deducted to work the cash equivalent of the loan. Interest charged by the company will be income for the company.

What if a business owes a director money?

A company doesn’t pay corporation tax on money lent to it by a director. However, if the director charges interest, the interest charged to the business on the loan counts as a business expense for the company and personal income for the Director. The Director will be subject to personal tax liability on that income. The company must pay the Director interest less income tax at the basic rate of 20%. The income tax must be reported and paid every quarter using form CT61.

Topics

Archive

- 2024

- March 2024 (1)

- January 2024 (1)

- 2023

- December 2023 (2)

- November 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (3)

- June 2023 (3)

- May 2023 (2)

- April 2023 (1)

- March 2023 (4)

- February 2023 (2)

Comments for What is a director’s loan account?