An Easy Landing

From June 2019, paper landing cards will begin to be phased out from UK ports (including Eurostar) for visitors from Australia, Canada, Japan, South Korea and the USA. The Chancellor also announced that certain PhD-level jobs will be exempted from any current visa caps.

Tax Rates & National Living Wage

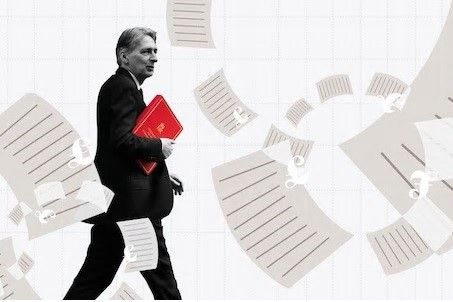

Philip Hammond’s commitment to declare any major changes in the Autumn budget has continued this year, so there were no big announcements made on tax measures beyond what we learned back in October. The following will apply from the 6th of April 2019:

- Increase in personal allowance from £11,850 to £12,500.

- Increase in higher rate threshold from £46,000 to £50,000

- Increase in the National living wage for over-25s from £7.83 per hour to £8.21 per hour

Building Homes

There will be a further £3 billion available for the building of up to 30,000 affordable homes, along with a further £1 billion of loan finance available to small and medium builders of new homes via Barclays.

Making Tax Digital

The biggest change this coming year for many will be the introduction of Making Tax Digital (MTD) for VAT-registered businesses. The Chancellor announced that MTD will not be required for any other taxes or businesses in 2020, whilst also making it clear that HMRC will be taking a ‘light touch’ approach to compliance with no fines to be handed out in MTD’s first year for late filing. This leaves some breathing room for those businesses that are struggling to make the transition.

A Greener Future?

The Chancellor has made a pledge that by 2025, fossil-fuel based heating systems will no longer legal to install into new build homes, potentially spelling the end of the gas boiler.

Brexit

We can’t make it through without mentioning Brexit and it’s potential effect on the economy and the Chancellor addressed this directly in his speech. Making the announcement that he believed Britain’s economy would be in a stronger position should a deal be reached with the European Union, he pledged that the Treasury would be making a full three-year spending review before the summer recess on the condition that a deal could be reached. Also dependant on the outcome of a possible deal was the end of the current benefits freeze and austerity measures, which would be included in the spending review, and in the case of a no-deal Brexit a war chest of £26.6 billion for emergency measures was revealed.

Big Tech

The Chancellor renewed his pledge to make big technology companies ‘pay their fair share’ and ensure that they are doing their best to protect consumers from potential online threats.

Anything on your mind?

If there’s anything about these upcoming changes you’re not so sure about or you’d like to find out how they may apply to you or your business, we are happy to help.

Topics

Archive

- 2024

- March 2024 (1)

- January 2024 (1)

- 2023

- December 2023 (2)

- November 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (3)

- June 2023 (3)

- May 2023 (2)

- April 2023 (1)

- March 2023 (4)

- February 2023 (2)