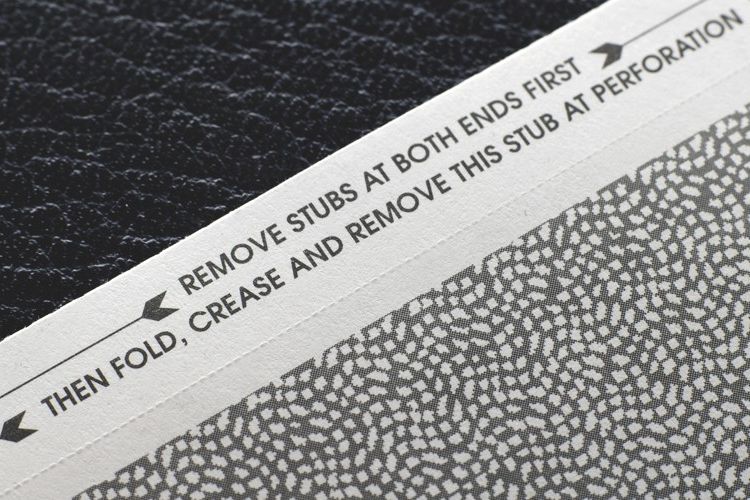

In an effort to try and tighten up confusion around zero-hours contracts along with employers who are still attempting to pay below the legal minimum wage, legislation has been brought in to attempt to ensure that workers can see how many hours they have worked and how their pay has been calculated. This will show deductions made for Tax, NIC and pension contributions.

Regular employees whose pay is calculated on an hourly basis must receive a payslip detailing the following information:

- Hours worked (if pay is based on an hourly rate) in the relevant pay period

- A total for each type of hourly pay if relevant (e.g overtime or bank holiday pay)

- Dates of which pay period their work relates to

- A breakdown of how the money will be paid (cash, cheque, bank transfer etc.)

- The payslips must be received on or before payday

Payslips do not need to be provided to self-employed workers, contractors or anyone who is not an employee of the business. However, if your business hires agency workers then they must receive a payslip from the agency that they are employed by detailing this information.

If an employee works for a fixed set of hours, for instance 30 hours a week on a salary-basis, the hours worked in this case do not have to be shown. However, any extra hours they work that they are paid separately for would have to be separately itemised on the payslip.

Those who are genuinely self-employed are not entitled to payslips and should instead provide an invoice to the business they are working for.

Topics

Archive

- 2024

- March 2024 (1)

- January 2024 (1)

- 2023

- December 2023 (2)

- November 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (3)

- June 2023 (3)

- May 2023 (2)

- April 2023 (1)

- March 2023 (4)

- February 2023 (2)